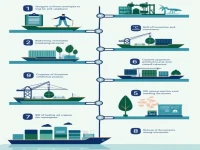

International Shipping Container Export Process Explained

This article elaborates on the process of container export in international shipping, covering steps such as inquiry, acceptance of entrustment, booking, packing, customs declaration, bill of lading confirmation, and fee settlement. By understanding these core steps, freight forwarders can operate more effectively, enhancing professionalism and efficiency in their operations. Continuous learning is essential for becoming a quality freight forwarder.